India, the world’s fastest growing major economy, is preparing to bear the brunt of US President Donald Trump’s trade war and 50% tariffs. In this backdrop, the Goods and Services Tax (GST) rate cuts couldn’t have come at a more opportune time.While FM Nirmala Sitharaman has clarified that the GST rate cuts had been in the works for several months, and the announcement is unrelated to US tariffs, a domestic consumption boost for an economy staring at uncertainty for its exports sector is a welcome move, feel experts.The Modi government has announced better-than-expected GST reforms and rate structure rationalisation, with a majority of items consumed by the common man and middle class set to see price cuts from September 22, the start of the Navratras. The move to put more disposable income in the hands of millions of consumers at the start of the festive season is widely expected to provide a consumption-led booster shot to India’s GDP growth.But will the GST rate cuts be enough to counter the impact of Trump’s 50% tariffs on India? We weigh in

GST rate cuts: Impact on GDP growth

Donald Trump administration’s 50% tariffs on India have rendered the country’s exports uncompetitive in the US markets – and America is India’s largest trading partner. Most experts expect the tariffs to hit over 50% of India’s exports to the US, a blow that would run in several billion dollars.But, India is largely a domestic consumption driven economy. The share of exports in its GDP growth is not large and experts believe the impact of Trump’s tariffs will range anywhere between 30 to 90 basis points. Besides, the government is also working on providing relief to exporters, and trade agreements with other countries will help Indian businesses find markets outside the US for their goods.According to Madan Sabnavis, Chief Economist, Bank of Baroda, “GST reforms will help lowering cost of production for companies which will be useful for them when competing globally. It can hence to a limited extent compensate for the higher cost imposed by the tariffs. It is not a cure for sure but a support.”Also Read | GST rate cuts bonanza! What is cheaper and dearer? Check full list of items in 0%, 5%, 18% & 40% slabs“GST is more to spur demand domestically and correct for inverted duty structure where it is existent,” he tells TOI.Sachchidanand Shukla – Group Chief Economist at Larsen & Toubro shares that a few studies peg the growth multiplier at 1.08, but depending on the elasticity of various segments & varying propensity of companies to pass on the benefits the net impact on GDP could lie anywhere between 500-900 bn.

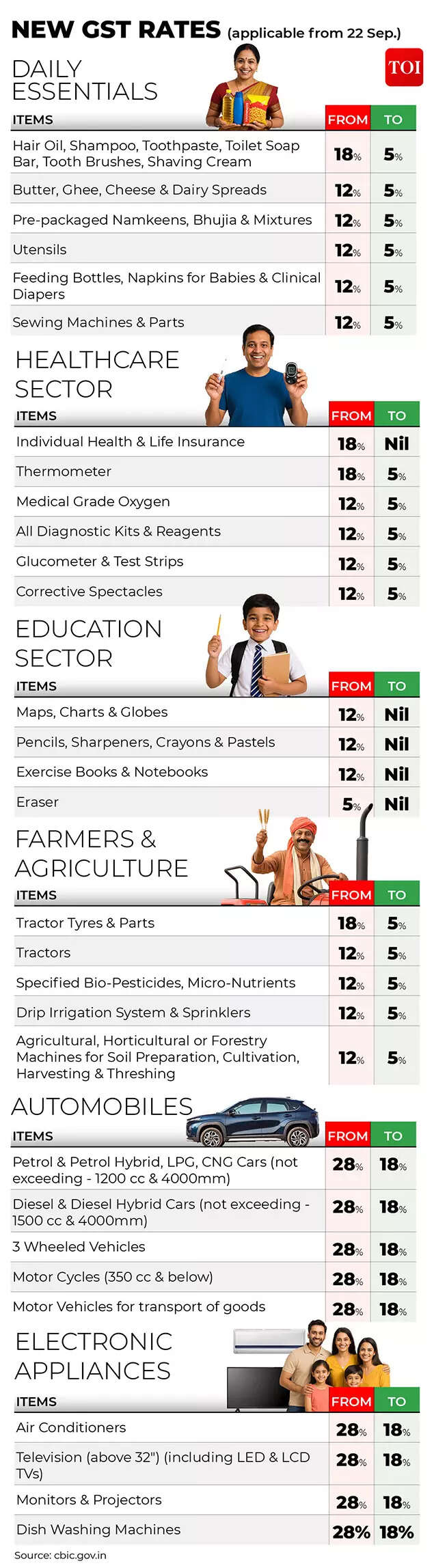

New GST rates

“However, that is still a short term view. The real benefit will compound over the medium to longer term by showcasing the Laffer Curve in effect with low rates/ prices leading to higher consumption, compliance and economic activity. So in the short term, it will be able to mitigate some of the adverse impact of US tariffs, possibly up to 0.4%, but the real macro impacts will be in the longer term via lower inflation, higher activity etc,” he tells TOI.Experts also say that a domestic consumption boost may be an effective counter to the ongoing global trade war. Radhika Rao, Senior Economist & Executive Director at DBS Bank, Singapore says, “The domestic anchor is likely to surface as an important offset for a challenging external environment this year. In this respect, policy support through direct and indirect tax relief, besides boost from a good monsoon and pay commission changes are expected to impart positive demand impulses into the economy.”“This is in addition to easing inflation, which has provided relief to real purchasing power. There is also a need for direct measures to support affected businesses due to the tariff announcements, especially smaller and labour-intensive firms,” Rao tells TOI.DK Srivastava, Chief Policy Advisor, EY India explains “As far as GST is concerned, major sectors benefiting from rate reduction and rationalization include textiles, consumer electronics, automobiles, and most food items. These are employment intensive sectors where the benefits of lower prices would be quite broad based.”Also Read | GST rate cuts from September 22! All you need to know about new tax rates for items – 75 FAQs answered“On the production side, sectors that would benefit include fertilizers, agricultural machineries and renewable energy. In these sectors farmers would benefit through lower input costs. Thus, there is a demand and efficiency improving impact which would offset some of the revenue loss. These positive effects would gather momentum over the medium term and the base broadening effects could eventually overtake the short-term revenue reduction effects,” he tells TOI.“On the whole, even with some slippage in the fiscal deficit to GDP ratio, we expect the real GDP growth to actually increase from existing estimates of 6.5% to 6.7% in 2025-26. This is likely to happen in spite of the US tariff hikes. Most of the tariff affected sectors such as textiles would recover relevant ground with the increase in domestic demand and export diversification to countries where new free trade agreements would become effective later in the year,” he adds.

GST rate cuts: What about hit on revenue collections?

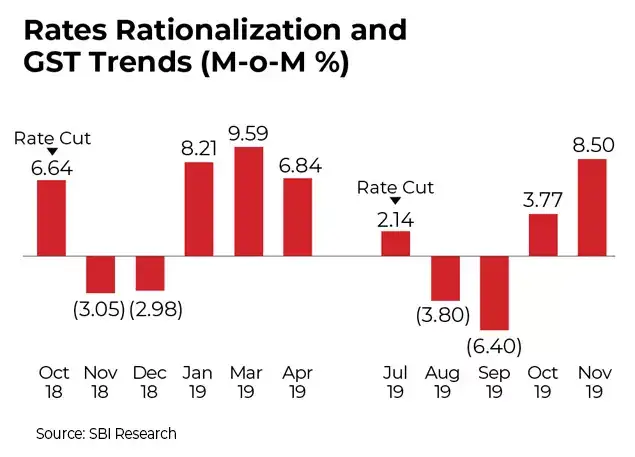

Revenue secretary Arvind Shrivastava estimates that on the 2023-24 consumption base, there would be an estimated impact of Rs 48,000 crore on tax collections. Shrivastava is confident that GST rate cuts would have the desired impact of generating buoyancy and spurring demand.Indeed an SBI Research analysis says that earlier rounds of GST rate changes, such as those in July 2018 and October 2019, suggest that rationalization does not necessarily weaken revenue collections. “Instead, the evidence points to a temporary adjustment phase followed by stronger inflows. While an immediate reduction in rates can cause a short-term dip of around 3–4% month-on-month (roughly ₹5,000 crore, or an annualized ₹60,000 crore), revenues typically rebound with sustained growth of 5–6% per month,” SBI says in its report.

GST rate rationalisation trends

“In past episodes, this dynamic has translated into additional revenues of nearly ₹1 trillion. Importantly, rationalisation should be seen less as a short-lived stimulus to demand and more as a structural measure that simplifies the tax system, reduces compliance burdens, and enhances voluntary compliance, thereby widening the tax base,” it adds.

Not just GST rate cuts – Other booster shots for economy

At the start of the year, FM Sitharaman announced huge income tax cuts in the new tax regime – the resulting tax savings for the middle class is expected to eventually feed into economic growth.Add to that the 1% repo rate cut by RBI, which has lowered EMIs of loan borrowers – yet another consumption boost for the economy.Additionally, the 8th Pay Commission is expected to be rolled out in the coming months, putting more money in the hands of lakhs of government employees.Also Read | GST rate cuts & rationalisation: Top winners & losers of new tax slabs – check listRetail inflation is also at a several-year low, a positive factor ahead of the festive season.The GST rate cuts are an icing on the cake for the above four factors. DK Srivastava of EY India says, “At the time when the Union Budget for 2025-26 was presented, the Finance Minister’s speech specified an estimate of foregone revenues of Rs 1 lakh crore for direct taxes mainly on account of personal income tax rate rationalization and reduction and Rs 2,600 crore for indirect taxes most of which related to concessions in custom duty rates. The proposed GST rate rationalization and reduction is expected to result in net revenue reduction of Rs 48,000 crore, which would be shared between the central government and the states.”“Correspondingly, the disposable incomes in the economy would go up by a similar magnitude resulting in augmentation of overall demand. In addition, there would be price effects for sectors where rate reductions lead to lower prices,” he concludes.