In a big cheer for Provident Fund subscribers, the Employees’ Provident Fund Organisation (EPFO) may roll out features like withdrawals from ATMs and ban-like transactions ahead of Diwali.The meeting, to be chaired by labour and employment minister Mansukh Mandaviya, is scheduled for October 10-11, although the final agenda remains pending, sources informed ET. The government intends to introduce certain advantages for approximately 80 million EPFO subscribers before Diwali to enhance spending patterns.

New EPFO features soon

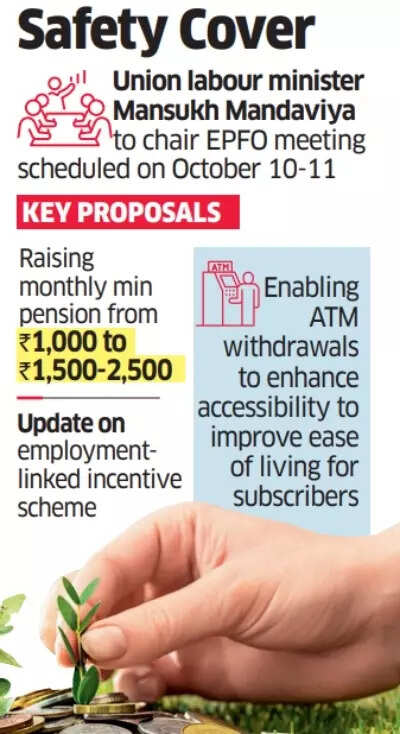

The EPFO may consider the EPFO 3.0 initiative at its meeting next month, aiming to introduce facilities similar to banking services, including options for withdrawing a portion of provident funds via ATMs or using them for UPI transactions.The organisation’s central board of trustees is also expected to review a proposal to increase the minimum pension from Rs 1,000 monthly to between Rs 1,500 and Rs 2,500, addressing a persistent request from trade unions.

EPFO: Safety cover

The apex decision-making authority of EPFO, the Central Board of Trustees, comprises members representing employers, employees, state governments and the central government. The suggestion to enable partial withdrawals via banks and UPI might encounter opposition from trade unions, who consistently maintain that provident funds are meant for retirement security.Trade unions express concern that allowing withdrawals through banking channels could undermine the fundamental purpose of these savings, particularly if used for purposes beyond those currently permitted by regulations, according to the ET report.The Employees’ Provident Fund & Miscellaneous Provisions Act currently permits automated withdrawals of up to Rs 5 lakh for specific needs such as health emergencies, educational expenses, matrimonial purposes and housing requirements, with processing completed within three days without manual intervention.The existing withdrawal system requires a minimum of two to three days for processing and relies on NEFT or RTGS transfers. The ATM withdrawal proposition forms part of EPFO’s modernisation initiatives, designed to enhance service delivery and accessibility for its account holders.