Bitcoin’s simplicity as a non-programmable asset strengthens its position as a store of value. The programmability of crypto does not equate to it being money; it represents value in diverse ways. Investors often misclassify crypto assets, failing to recognize their distinct nature compared to tr…

Key takeaways

- Bitcoin’s simplicity as a non-programmable asset strengthens its position as a store of value.

- The programmability of crypto does not equate to it being money; it represents value in diverse ways.

- Investors often misclassify crypto assets, failing to recognize their distinct nature compared to traditional investments.

- Achieving product-market fit in crypto requires targeting a specific niche due to the technology’s novelty.

- Solana’s engineering principles enable it to address scalable solutions through solvable problems.

- Solana outperforms many blockchains in transaction speed and cost, enhancing its competitive edge.

- Future enhancements could make Solana significantly faster, cheaper, and more developer-friendly.

- NFTs extend beyond digital art, offering broader applications across industries.

- Stablecoins and trusted platforms like Aave are pivotal in restoring confidence post-FTX collapse.

- Blockchains should concentrate on financial technologies rather than solving unrelated problems.

- The FTX incident underscores the necessity for high-trust use cases in the crypto market.

- Emphasizing financial applications in blockchain can lead to more effective technological solutions.

- Solana’s transaction efficiency and cost-effectiveness set a benchmark in the blockchain space.

Guest intro

Mert Mumtaz is the co-founder and CEO of Helius, a Solana developer infrastructure platform providing RPCs, webhooks, and APIs. He previously worked as a software engineer at Coinbase, where he researched blockchains and built NFT bots for Solana in his spare time. He co-founded Helius in June 2022 to support developers building scalable applications on Solana.

Bitcoin as a store of value

- Bitcoin’s approach is seen as a better use case for a store of value due to its non-programmable nature.

I really like bitcoin’s approach of not doing anything that seems much better to me… that’s a much better use case for that as the store of value argument.

— Mert Mumtaz

- The distinction between Bitcoin and programmable crypto highlights its stability.

- Bitcoin’s simplicity is a strength in the context of value preservation.

- The focus on Bitcoin as a store of value contrasts with other digital assets that offer programmability.

- Bitcoin’s role as a stable store of value is emphasized over its transactional capabilities.

- The non-programmable nature of Bitcoin aligns with its purpose as a value holder.

- Understanding Bitcoin’s unique position in the crypto ecosystem is crucial for investors.

The role of programmability in crypto

- The programmable element of money does not inherently make it money itself.

The programmable element of money doesn’t make it money itself… we can think of it as value but it doesn’t have to be money.

— Mert Mumtaz

- Programmability in crypto represents diverse forms of value rather than traditional money.

- Differentiating between crypto as money and as value holders is essential.

- Programmable features in digital assets offer unique functionalities apart from being money.

- The role of programmability is to enhance the utility of digital assets beyond monetary functions.

- Understanding the distinction between value representation and money is key in crypto.

- Programmability adds layers of functionality to digital assets, broadening their use cases.

Misconceptions in crypto investment

- Investors often misunderstand the distinct nature of different asset types in crypto.

It’s like saying you know why would you invest in robinhood when you’ve invested in gold it’s like they’re just completely different asset types with completely different theses on basically everything.

— Mert Mumtaz

- Recognizing the differences between various crypto assets and traditional investments is crucial.

- Misclassification of crypto assets can lead to misguided investment strategies.

- Each crypto asset type has unique characteristics and investment theses.

- Understanding the specific nature of crypto assets is vital for informed investment decisions.

- The diversity of crypto assets requires tailored investment approaches.

- Investors should be aware of the distinct value propositions of different digital assets.

Achieving product-market fit in crypto

- Finding product-market fit in crypto requires focusing on a small niche.

The thing to understand especially in crypto when it’s newer technology is that you want to reduce you you you want to find pmf in a very small niche.

— Mert Mumtaz

- Targeting a specific niche is essential due to the novelty of crypto technology.

- Product-market fit is crucial for the success of emerging technologies like crypto.

- A strategic focus on niche markets can accelerate the adoption of crypto solutions.

- Understanding the importance of product-market fit is key for crypto entrepreneurs.

- Narrowing down the target market enhances the chances of success in the crypto space.

- The unique nature of crypto technology necessitates a focused approach to market entry.

Solana’s engineering philosophy

- Solana’s engineering approach allows it to solve problems not barred by the laws of physics.

If I take that playground that let’s say foundation then I can build structures on top of it that I know will stick because they obeyed the laws of physics and so that is to say all the problems that solana had in 2021 were soluble engineering problems.

— Mert Mumtaz

- Solana’s design principles focus on scalable solutions through solvable engineering challenges.

- Understanding Solana’s engineering philosophy provides insights into its scalability.

- Solana’s approach differentiates it from other blockchain technologies.

- The emphasis on engineering solutions positions Solana for long-term scalability.

- Solana’s foundational design principles enable the development of robust blockchain solutions.

- Solana’s engineering philosophy is a key factor in its competitive advantage.

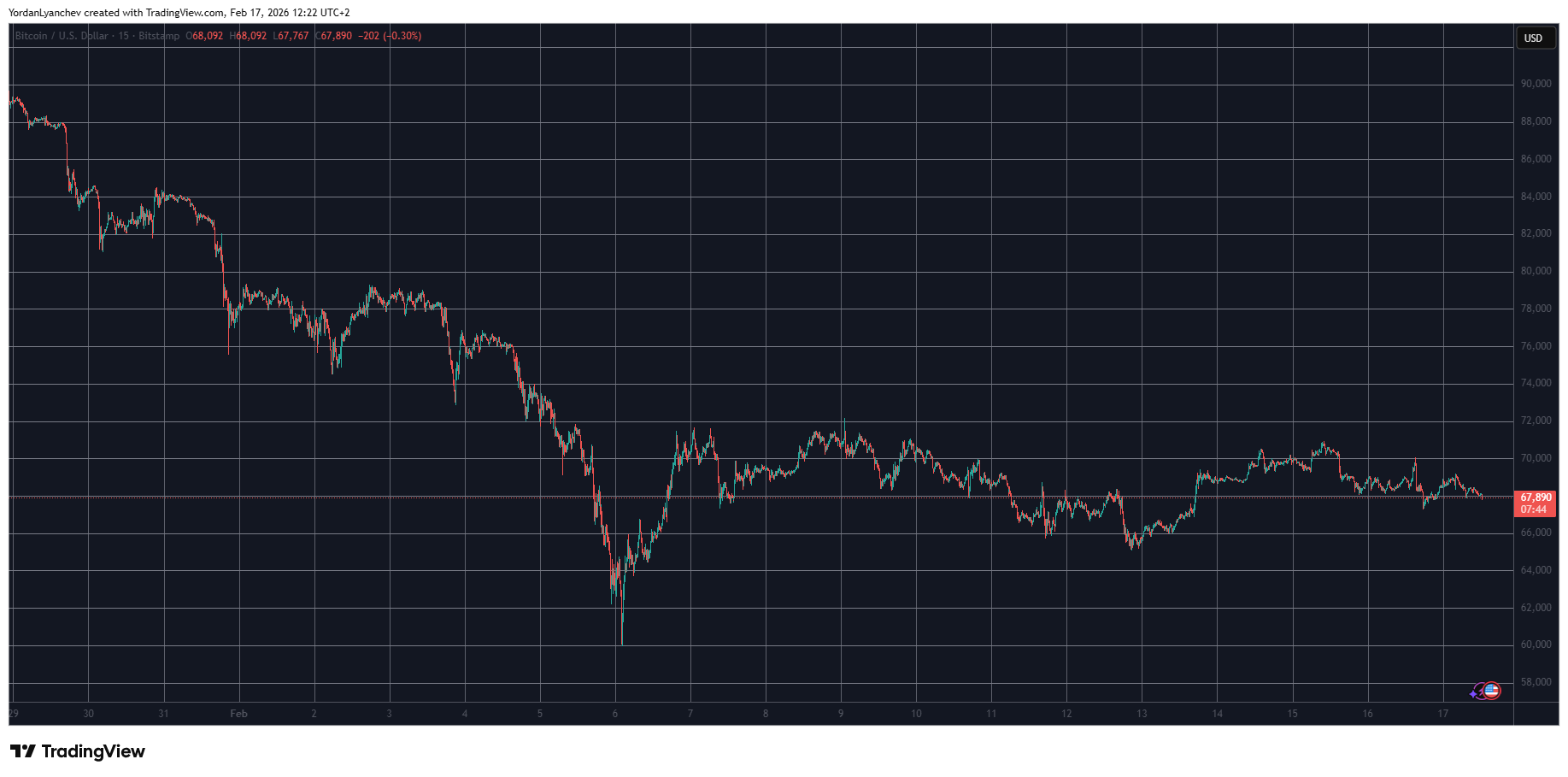

Solana’s transaction efficiency

- Solana processes more transactions per second than most chains in crypto combined at a lower median fee.

Today solana does more transactions per second than most chains in crypto combined and it does that not only is it more scale it does it at a lower median fee.

— Mert Mumtaz

- Solana’s transaction throughput sets it apart in the blockchain space.

- The cost-effectiveness of Solana’s transactions enhances its appeal to users.

- Solana’s efficiency in transaction processing is a significant competitive advantage.

- Understanding Solana’s transaction capabilities is crucial for evaluating its market position.

- Solana’s transaction efficiency contributes to its scalability and user adoption.

- The lower median fee of Solana transactions makes it an attractive option for developers.

Solana’s future potential

- Solana can become 10 times faster, 100 times cheaper, and at least twice more usable for developers compared to other blockchains.

I think we can become 10 x faster a 100 times cheaper and at least two times more usable for developers to then build applications for.

— Mert Mumtaz

- Solana’s potential improvements highlight its commitment to enhancing blockchain technology.

- The projected advancements in speed, cost, and usability position Solana for future growth.

- Solana’s focus on developer usability is crucial for expanding its ecosystem.

- Understanding Solana’s future potential is key for assessing its long-term viability.

- The ambitious goals for Solana’s development reflect its strategic vision.

- Solana’s future enhancements could significantly impact its market competitiveness.

The evolving role of NFTs

- NFTs are a technology that unlocks much more than just digital art; they have broader applications.

NFTs can actually do… they’re a technology that’s not just about you know jpegs.

— Mert Mumtaz

- NFTs offer potential utility beyond digital collectibles, impacting various industries.

- Understanding the broader applications of NFTs is crucial for future developments.

- The perception of NFTs is evolving as their potential use cases expand.

- NFTs represent a transformative technology with diverse applications.

- The role of NFTs in the digital economy is expanding beyond art and collectibles.

- Recognizing the broader impact of NFTs is key for understanding their future trajectory.

The importance of stablecoins and trust

- Stablecoins and high-trust use cases like borrowing and lending are crucial in the crypto space.

Like ftx blowup did not help with trust but like so that’s another so stable coins and high trust use cases like borrow and lending I think like aave’s still the gold standard.

— Mert Mumtaz

- Stablecoins play a vital role in maintaining trust in the crypto ecosystem.

- High-trust platforms like Aave are essential for rebuilding confidence post-FTX collapse.

- The FTX incident underscores the need for reliable and trustworthy crypto solutions.

- Stablecoins and lending platforms are pivotal in restoring market confidence.

- Understanding the role of stablecoins is crucial for navigating the crypto landscape.

- Trustworthy platforms are key to the sustainable growth of the crypto market.

Strategic focus for blockchain development

- Blockchains should focus on financial use cases rather than trying to solve all problems.

A lot of people make the mistake of trying to shoehorn blockchains into solving all sorts of different problems but fundamentally they’re just financial technology.

— Mert Mumtaz

- Prioritizing financial applications can lead to more effective blockchain solutions.

- The strategic focus on financial use cases enhances the impact of blockchain technology.

- Understanding the core purpose of blockchains is crucial for their development.

- Financial applications represent the most promising area for blockchain innovation.

- The emphasis on financial technology aligns with the strengths of blockchain systems.

- A focused approach to blockchain development can maximize its potential benefits.