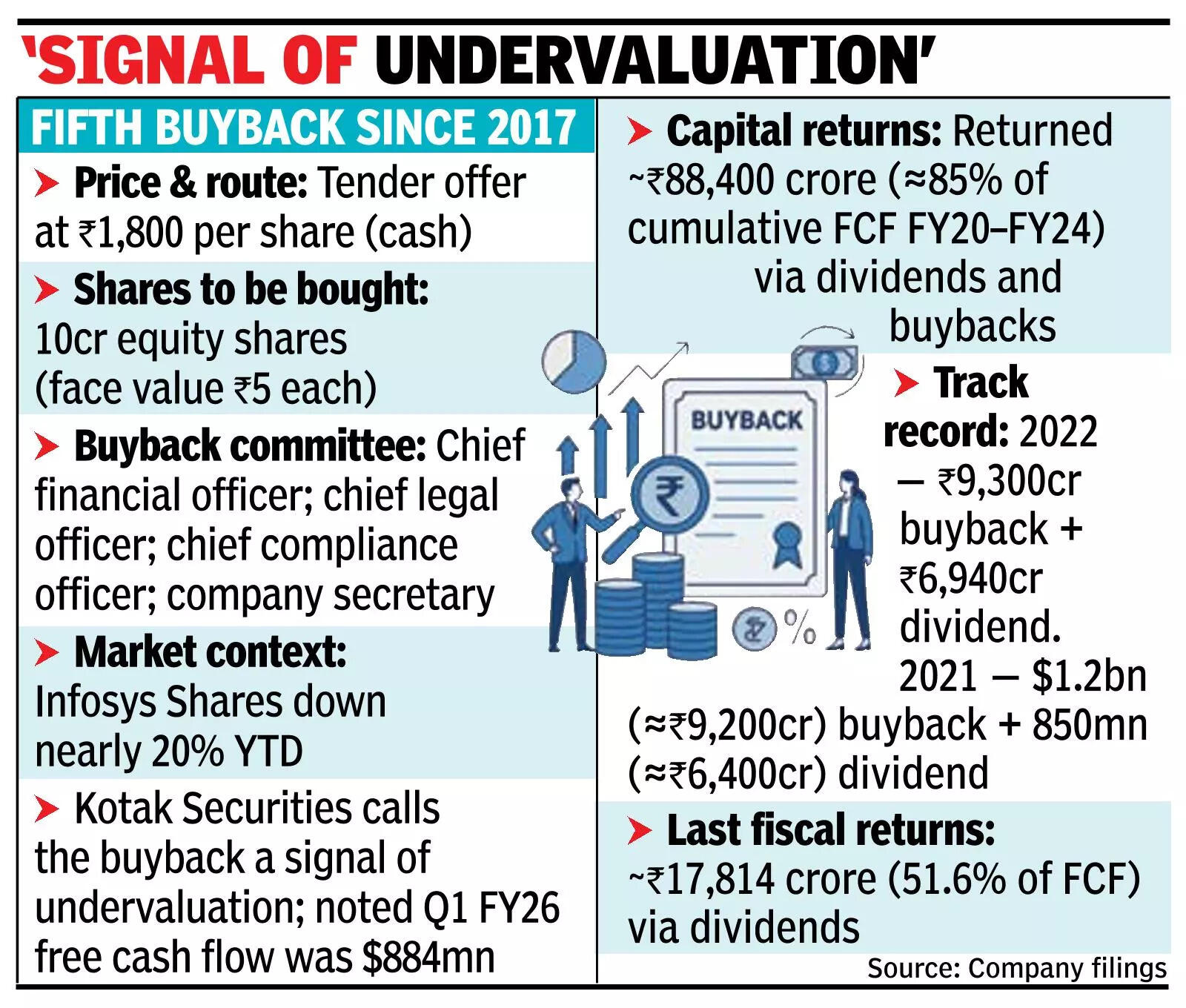

BENGALURU: The Infosys board approved a Rs 18,000 crore share buyback on Thursday, the largest in the company’s history and marking its fifth buyback since 2017. The buyback, to be conducted through the tender offer route, will be at a price of Rs 1,800 per share in cash, involving the purchase of 10 crore equity shares with a face value of Rs 5 each. This represents about 2.4% of the company’s total paid-up equity capital. The board has also set up a buyback committee comprising the chief financial officer, the chief legal officer, the chief compliance officer, and the company secretary. The record date for identifying eligible shareholders will be announced later. The buyback size is within regulatory limits, as it does not exceed 25% of the company’s paid-up capital and free reserves, based on its latest audited financial statements for the June quarter. The actual number of shares and percentage of paid-up capital bought back will be confirmed after the buyback is completed.The move comes at a time when Infosys shares fell nearly 20% year-to-date. With macroeconomic conditions remaining uncertain-particularly in sectors such as logistics, consumer products, and manufacturing-clients are increasingly focused on cost optimisation.

Brokerage firm Kotak Securities, in a recent note, said the buyback signals undervaluation that prompted management to act. “Buybacks utilise surplus cash without committing to long-term capex. Infosys’ free cash flow in Q1 FY2026 was $884 million, enabling non-disruptive capital deployment,” the note said. In 2022, Infosys announced an open market share buyback of Rs 9,300 crore to reward shareholders, alongside an interim dividend of Rs 6,940 crore. This was its fourth buyback in less than six years. In 2021, the company bought back shares worth $1.2 billion (about Rs 9,200 crore) and paid a dividend of $850 million (Rs 6,400 crore). Overall, Infosys returned approximately Rs 88,400 crore-or 85% of its cumulative free cash flow for FY20-FY24-through dividends and buybacks, in line with its capital allocation policy. Starting FY25, Infosys has continued with its policy of returning about 85% of free cash flow cumulatively over a five-year period through a combination of semi-annual dividends, buybacks, or special dividends. In the last fiscal, including the final dividend, the company returned about Rs 17,814 crore-51.6% of its free cash flow for the year-through dividends, in line with this policy.