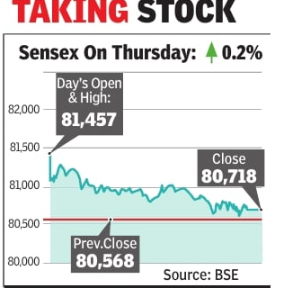

As govt prepared for the first major rejig of GST rates since its launch eight years ago, investors on Dalal Street followed the classic stock market strategy of ‘buy on expectations, sell on news’.In the run up to the announcement, stocks of several companies that investors expected would benefit from the GST rate changes, had rallied. But after the actual rejig was announced, the initial euphoria soon gave way to a flat closing for benchmark indices, including the stocks of most of the rate-cut beneficiaries.On Thursday, sensex opened the session up nearly 900 points but gave up most of the gains by the day’s closing and ended just 150 points (0.2%) up at 80,718 points.

.

“In-line outcome of GST rationalisation (move) and the ongoing tariff threats from the US exerted a negative impact on the market (on Thursday),” said Vinod Nair of Geojit Investments. As the negative impacts of the US tariff-related issues start affecting the Indian economy, “the GST rate cut is expected to significantly boost domestic consumption demand, countering the adverse effects of (India’s) diminished export competitiveness”, Nair said.Among the sectoral indices, BSE’s auto index closed 0.7% higher while the consumer discretionary index closed a marginal 0.2% higher. The consumer durables index was barely changed over Wednesday’s close. This, despite most companies from these sectors being perceived to be the major beneficiaries from the GST rejig, effective Sept 22.On Thursday, after several sessions of strong selling, net outflow by foreign funds from the stock market was relatively muted at Rs 106 crore. Domestic funds, on the other hand, were net buyers at Rs 2,233 crore, BSE data showed.The day’s session, despite the gains for leading indices, left investors poorer by Rs 1.5 lakh crore with BSE’s market capitalisation now at Rs 451 lakh crore.In the commodities space, the two precious metals — gold and silver — witnessed some fall in prices, mainly due to profit-taking after about a week’s rally to new all-time high levels.On Friday, the US is scheduled to announce the nonfarm payroll data. In case this also shows some weakness compared to earlier months’, the chances of a cut in interest rate in the US would rise. That in turn could lead to increase demand and higher prices for precious metals, analysts said.