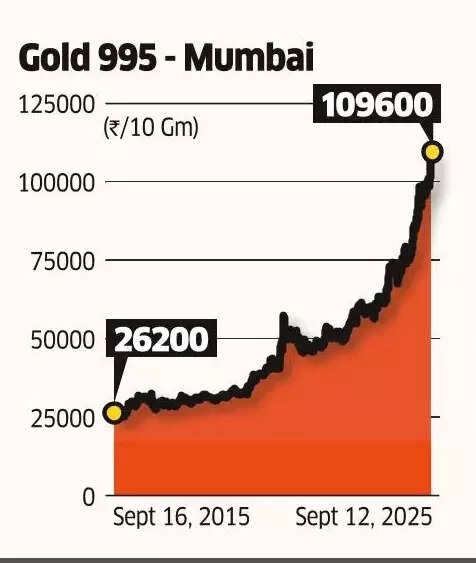

Gold vs Sensex: Gold has delivered superior returns compared to Sensex over a several year horizon. Gold has surpassed domestic equities in terms of returns, primarily due to unprecedented buying by global central banks and investors seeking protection against inflation. The precious metal has yielded 50.1% returns in rupee terms during the last year, whilst the Sensex declined by 1.2%.The significant uptick over the past year can be attributed mainly to central banks’ acquisitions, as uncertainties related to trade disputes have increased the appeal of secure investments, according to an ET report.“Central banks continue to buy gold with about 25% of purchases coming from them,” says Sridhar Sivaram, investment director at Enam Holdings. “They are buying gold because of the ongoing tariff wars and as a diversification against the US treasury,” he was quoted as saying.

Gold outperforms Sensex

Gold has demonstrated superior performance compared to Sensex across multiple timeframes spanning three, five, ten and twenty years.In the past three years, gold yielded an annual return of 29.7%, surpassing the Sensex’s 10.7%. The five-year performance shows gold achieving 16.5% returns, slightly higher than the Sensex’s 16.1%.Looking at longer periods, gold’s performance remained robust with 15.4% returns over a decade, exceeding the Sensex’s 12.2%. The two-decade analysis reveals gold maintaining 15.2% returns compared to the Sensex’s 12.2%.

Why are gold prices rising?

Experts indicate that countries are shifting away from dollar-based reserves towards gold holdings. They recognise gold as a reliable value repository and protection against currency deterioration.“Gold extends beyond being only a hedge against inflation, as the US Federal Reserve is on the stage to start cutting interest rates with hotter inflation,” says NS Ramaswamy, head-commodity desk, Ventura securities.

Gold 995 – Mumbai

He further notes that anticipated US Federal Reserve rate reductions this month and ongoing uncertainty regarding President Donald Trump’s tariff decisions will sustain gold’s strong position.Recently, gold prices on Comex reached an unprecedented $3,715.2 per troy ounce, whilst silver exceeded $43, achieving its highest value in 14 years.

What is the outlook for gold prices?

Experts indicate that with gold prices having already surged 38%, future increases might be more modest. Nevertheless, portfolio diversification should include gold allocation between 10-15%. “Investors should continue to allocate 10% to gold in their portfolios as it is the only hedge against currency, but you should not expect returns to be as high as the previous year,” said Sivaram.For optimal investment strategy, Ramaswamy suggests maintaining 15% gold allocation, recommending purchases during price corrections.Recent significant price appreciation has led several market observers to favour equity investments over gold.According to research by Edelweiss Mutual Fund comparing Sensex to Gold ratios, gold currently appears overvalued relative to equities. Historical data suggests equity outperformance when the ratio dips below 1, whilst higher ratios typically indicate stronger gold performance.“The current ratio is 0.76, which is below the long-term average of 0.96,” Niranjan Avasthi, SVP and head- product, marketing & digital at Edelweiss Asset Management. “In the past when this ratio had been below 0.8, the BSE Sensex has given an 3 year average forward return of 25.12% compared to gold that could return 7.21%.”(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)