Crypto fear index fell from 12 to 10 this week as Iran’s Hormuz drills raised oil and energy risk for BTC miners.

Summary

- Crypto fear and greed index dropped from 12 to 10 as Iran’s naval drills briefly closed the Strait of Hormuz, a major oil route.

- Roughly 20–25% of seaborne oil and about 20% of global petroleum consumption move via Hormuz, making closures a direct shock channel to energy prices.

- Higher energy costs can compress BTC mining margins and force some miners to scale back or sell holdings, tightening market liquidity during macro uncertainty.

Cryptocurrency market sentiment declined this week as geopolitical tensions escalated in the Middle East, with Iran conducting military drills that temporarily shut down the Strait of Hormuz, according to market data and reports.

The crypto fear and greed index dropped from 12 points on Monday to 10 points on Tuesday, reflecting subdued market sentiment that coincided with rising tensions between Iran and the United States.

The Strait of Hormuz serves as a critical passage for global oil transport, with approximately 31 percent of all crude oil transported across oceans passing through the waterway. Disruptions to this route typically result in higher oil prices and increased energy costs globally.

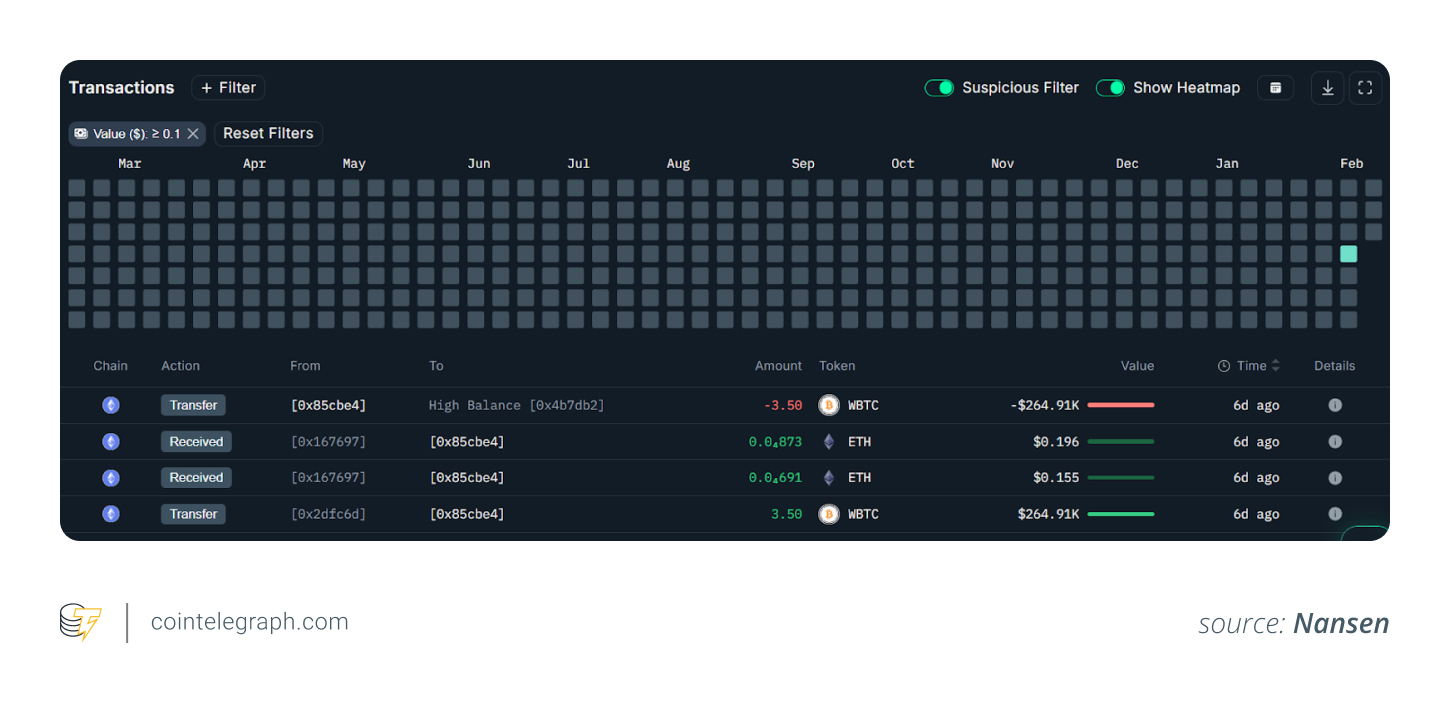

Elevated energy costs could impact Bitcoin mining operations, potentially forcing some miners to reduce operations or liquidate cryptocurrency holdings to cover operational expenses, according to market analysts. This represents one mechanism through which geopolitical events affect cryptocurrency valuations and market liquidity.

Iran’s temporary closure of the strait occurred as part of military exercises, though the action came amid heightened tensions with the United States. Iranian and U.S. officials met in Geneva, Switzerland, this week for diplomatic talks, according to reports.

The outcome of those negotiations could determine the trajectory of regional tensions and their impact on global markets. A breakdown in talks could signal escalation, while successful de-escalation might improve market sentiment, analysts noted.

Cryptocurrency trading volumes remained low this week as investors awaited key U.S. economic data releases. The U.S. Federal Reserve was scheduled to release durable goods data mid-week, with Personal Consumption Expenditures (PCE) data expected Friday. Traders typically await such data to establish directional market positions.

Macro factors have influenced cryptocurrency markets in recent months, with risk-on assets including digital currencies showing sensitivity to geopolitical events and global economic conditions, according to market observers.