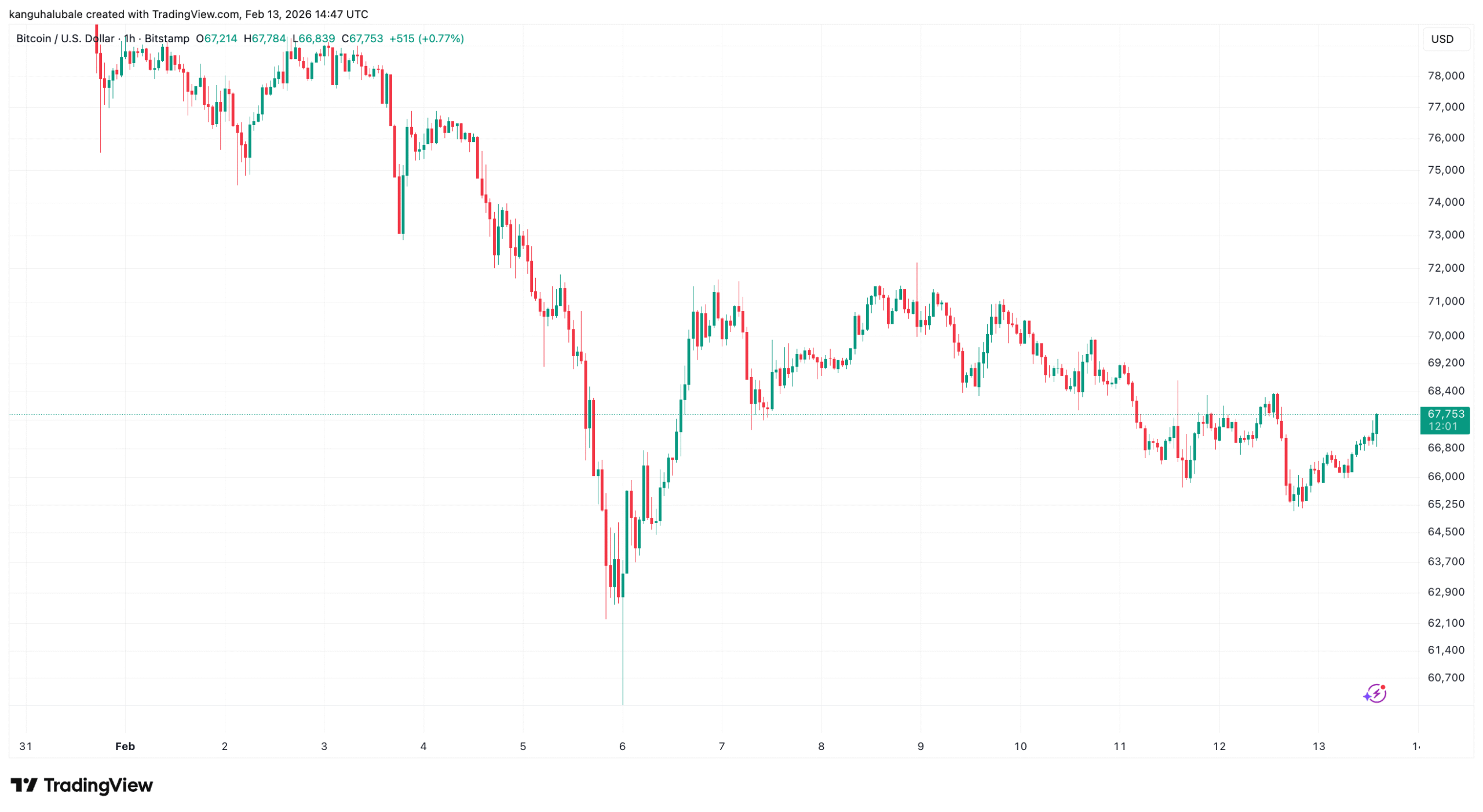

Bitcoin flirted with US$60,000 last week before staging a modest recovery, leaving altcoins to nurse bruised egos and investors to wonder if they’re holding the next “dead token.” Meanwhile, AI stocks are stealing capital and attention like a toddler in a candy store. Welcome to crypto’s latest de-risking phase, where patience is as much an asset as Bitcoin itself.

Summary

- Bitcoin dropped roughly 50% from its October 2025 high, with altcoins lagging heavily as investors rotate capital toward AI, defensive narratives, and larger, more durable crypto assets.

- Hawkish Fed expectations, a cooling labor market, and geopolitical uncertainties are limiting liquidity and short-term risk appetite, keeping rate cuts off the table and sustaining volatility.

- Despite the drawdown, institutional participation, stablecoin liquidity, real-world asset tokenization, and DeFi adoption continue to grow, laying the groundwork for medium-term opportunities once market sentiment shifts.

According to a Binance analysis, markets are caught between two powerful forces: a rotation of capital away from speculative crypto bets toward AI and defensive narratives, and a macro backdrop dominated by hawkish Fed expectations, potential government shutdown jitters, and global trade tensions.

The result is a market that’s temporarily favoring durability over hype, forcing smaller tokens to either prove their worth or quietly fade into obscurity. For Bitcoin, this 50% drawdown from last October’s all-time high is more of a cleansing than a collapse—and it may be laying the groundwork for the next chapter.

Investors are learning a lesson in selective attention. As Bitcoin consolidates around US$60,000–65,000, altcoins continue to lag, dragged down by a flood of 2025 token launches. Roughly 11.6 million of the 20.2 million new tokens released last year—many with little to no users or revenue—have already vanished from active trading.

CoinGecko and Binance report that more than half of these new entrants have endured brutal drawdowns, leaving hype-driven speculators nursing losses while projects with real fundamentals fight for visibility.

Yet the long tail isn’t completely dead. Some smaller assets have shown muted moves recently, reflecting that much of the early deleveraging has already occurred. In other words, the selling pressure is tiring—not that buyers are back in force. Meanwhile, equity markets have also repriced risk, particularly in software, where AI-driven disruption has outperformed Bitcoin in relative terms, creating a liquidity tug-of-war between crypto and tech.

The irony?

The same AI narrative driving stocks higher is one of the most compelling use cases for blockchain: machine-speed payments, programmable money, and cross-border settlements. Short-term, AI is siphoning attention. Medium-term, it may become crypto’s most loyal customer.

Macro factors remain the primary driver. January’s U.S. jobs report showed 130,000 new positions and unemployment at 4.3%, superficially encouraging but revealing a weak underlying trend once benchmark revisions for 2025 are considered. The Fed, under incoming chair Kevin Warsh, is unlikely to loosen policy soon, keeping liquidity tight—a headwind for Bitcoin, historically sensitive to shifts in global cash flows.

Despite the drawdown, structural tailwinds persist. Spot BTC ETF assets under management have only modestly declined, hinting at a sticky investor base focused on strategic allocation rather than momentum chasing. Digital asset treasuries, by contrast, are less aggressive buyers, suggesting balance-sheet strategies are becoming more conservative. Stablecoins have remained plentiful, maintaining the plumbing for future on-chain transactions.

Real-world assets (RWAs) and tokenization have become the new safe harbors. Tokenized treasuries, commodities, and yield-focused structures now total nearly US$25 billion, with tokenized gold surging over 50% since the start of 2026. Tether Gold (XAUT) recently exceeded US$2.6 billion in market cap, a reminder that even in a risk-off phase, crypto can find its bedrock.

DeFi continues to converge with traditional finance. BlackRock’s move to make shares of its tokenized U.S. Treasury fund BUIDL tradable via UniswapX, along with its purchase of UNI governance tokens, signals institutional confidence in decentralized infrastructure. Liquidity exists; it’s just selective, waiting for the right catalyst.

Looking ahead, markets remain poised for volatility while macro signals clarify. Bitcoin’s realized price—roughly US$55,000—marks a psychological pivot point, where holders near breakeven can amplify swings. Yet the difference from prior cycles is clear: this is a deeper, structurally stronger market. Stablecoin rails are solid, RWAs are scaling, DeFi adoption continues, and institutions are quietly embedding digital assets into portfolios.

History suggests that when prices compress but fundamentals advance, conviction builds beneath the surface. Once risk reprices, the winners of this patient phase—projects with real utility, institutional backing, or durable narratives—are often the ones to lead the next leg up. In crypto, as in comedy, timing is everything: the punchline comes after the pause.