The Donald Trump administration’s potential move to impose a tax on jobs outsourced outside the US have sent jitters in the Indian IT sector. The potential introduction of legislation by a Republican senator to impose taxes on IT services outsourcing in the United States poses significant risks to Indian technology firms, potentially undermining their competitive pricing advantage and affecting their business operations.This buzz follows a recent social media post shared by Peter Navarro, the US President’s senior counsellor for trade and manufacturing, suggesting tariffs on all outsourcing and foreign remote workers. The timing is particularly challenging as the industry faces existing pricing pressures and reduced deal activity due to cautious tech spending and artificial intelligence disruption.The “Halting International Relocation of Employment Act” (HIRE Act), put forward by Republican Senator Bernie Moreno in the US Senate on Saturday, proposes a 25% tax on US companies that outsource employment abroad. This unprecedented focus on the services sector in US trade discussions has caught Indian IT firms unprepared.

How will Trump admin’s HIRE Act harm Indian IT sector?

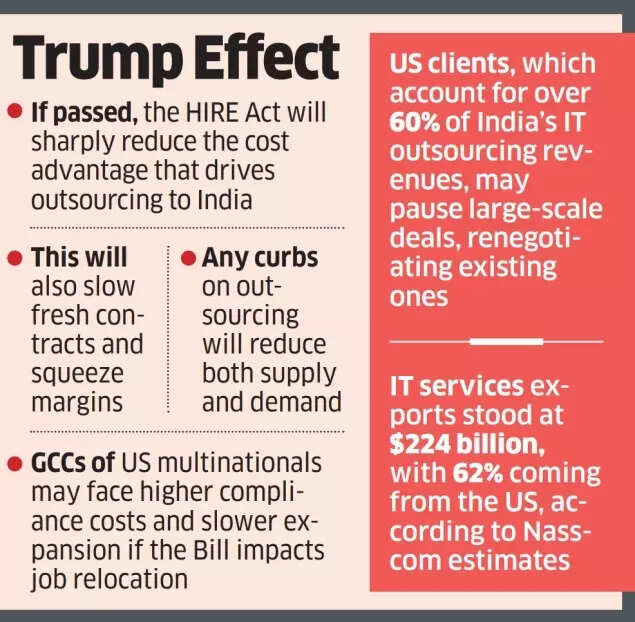

Industry experts caution that the passage of this Bill could lead to further spending reductions by US clients, who currently generate more than 60% of India’s IT outsourcing income.

Trump effect

“The proposed HIRE Act would substantially diminish the financial benefits of outsourcing to India,” explained Rohit Jain, managing partner at law firm Singhania & Co. “This could impact new contract acquisitions, affect profit margins, and compel Indian IT companies to seek growth opportunities in markets beyond the United States,” he told ET.Also Read | Trump tariffs on India’s software exports? Why IT sector is worried – double taxation, visa tightening may deal a blowJain indicated that many US clients might suspend major agreements, seek contract modifications, or relocate operations domestically to mitigate policy-related risks. “Some might maintain relationships with Indian providers whilst seeking more favourable terms, given the suppliers’ challenging position,” he noted. “Cost pressures may increase, particularly for basic IT services such as application development and maintenance, although advanced digital transformation and AI projects might remain less affected.“IT organisations are expanding their presence across Asia, Japan, Australia, Nordic countries and the Middle East to secure new customers, whilst maintaining significant dependence on US markets.“When combining excise tax, federal corporate tax and state-specific taxes, the total cost increase for offshore services could reach up to 60%,” stated Nitin Bhatt, technology sector leader, EY India.“Many clients may ask their IT service providers to absorb the tax impact by offering tax-inclusive pricing or reducing fees,” he said, noting that organisations might increase their local recruitment in the US whilst reducing visa-dependent teams.“Unlike past downturns driven by economic cycles, this crisis is man-made, with repercussions not only for Indian IT providers but also for US clients already grappling with rising costs from tariffs and visa restrictions,” said Saurabh Gupta, president at research and advisory services firm HfS Research according to the ET report.Also Read | Hyundai raid fallout, US work visa system hurdles: How Trump’s Made-in-US dream is being paralysed – explainedHe further stated that restrictions on outsourcing would affect both supply and demand, resulting in costlier and less reliable service delivery.SBICaps research indicates that the US remains India’s primary export destination, comprising 17.7% of total exports in FY24. India maintains a trade surplus of $45.7 billion with the US. This includes $38 billion in goods trade, with services (primarily IT and software) accounting for the remainder.According to Nasscom estimates, IT services, including hardware, generate $224 billion in export revenue, with 62% originating from the US market.Arun Prabhu, partner (head – technology) at law firm Cyril Amarchand Mangaldas, said the Bill, as drafted, could make outsourcing “significantly more expensive” for US entities.“It’s currently very unclear on what the final language of the Bill will look like. While a partisan proposal may seem attractive, it’s very unclear how some types of activity such as development of intellectual property like hardware and software which is sold or used in global markets (including the US) will be treated,” he added.The implications could significantly affect global capability centres (GCCs), which function as technological hubs for major US multinational corporations and technology companies with substantial Indian operations. These organisations maintain a considerable workforce presence in India.Jain of Singhania & Co. noted that whilst GCCs do not utilise vendor-client billing structures, any comprehensive tax system that imposes penalties on job relocation might increase regulatory expenses and decelerate growth strategies.