Bitcoin’s long-term price structure may look chaotic on lower timeframes, but one crypto analyst believes it is following a more predictable pattern on larger timeframes.

In a recent post on X, analyst Tony outlined a macro cycle framework that he says has consistently defined the best windows to accumulate Bitcoin and the best periods to exit around cycle highs. His theory is based on historical bull and bear market durations stretching back to 2015, and he claims the current cycle is following that same pattern almost perfectly.

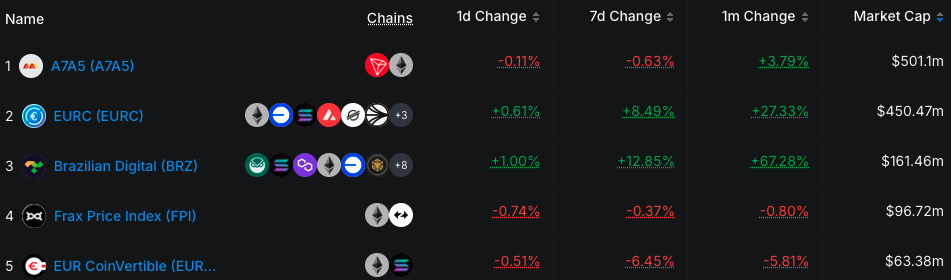

The 1,066-Day Bull And 365-Day Bear Pattern

According to Tony, Bitcoin’s market cycles have followed a remarkably consistent structure over the past decade. Each major bull market has lasted roughly 1,066 days, followed by a bear phase of about 365 days.

The first example he highlights runs from January 8, 2015, to December 17, 2017, a 1,066-day expansion that ended near the cycle peak. That was followed by a one-year decline into December 2018. The same pattern repeated from December 16, 2018, to November 10, 2021, another 1,066-day bull run, followed by a 365-day bear market into November 2022.

According to Tony, the current cycle is no different. The most recent bull market was dated from November 22, 2022, to October 6, 2025, right when Bitcoin reached a peak price of $126,080. Interestingly, this period once again totaled approximately 1,066 days.

Keeping this cycle of bull and bear periods in mind, the subsequent bear phase, he suggests, should run from October 7, 2025, to October 5, 2026, completing another 365-day correction. This means Bitcoin could continue to trade in corrections of lower highs and lower lows until early October 2026. However, the timing is not perfect to the exact day, and there can be a 10- to 20-day variance to the predicted date.

The chart attached to his post, shown below, divides these cycles into green expansion zones and red correction phases. Previous peaks around $69,000 in 2021 and $126,000 in 2025 are marked clearly, with the projection being a move to $40,000 and another return to $200,000 before the next red correction zone takes over.

Final Capitulation Could Still Be Ahead

In a separate post, Tony warned that the next major Bitcoin bottom may not yet be in place. The analyst projected further declines until Bitcoin enters into a strong support region between $40,000 and $50,000, with a potential bottom forming between mid-September and late November 2026.

He contrasted two emotional extremes in the analysis: early buyers celebrating perceived bargains during a falling market and later participants paralyzed by fear as the price reaches deep support.

At the time of writing, Bitcoin is trading at $66,950, sitting 47% below its October 2025 all-time high but still significantly above the $40,000-$50,000 identified as a potential final bottom zone. This projection means that Bitcoin could still fall further by 50% to 40% before it establishes a bottom.

Featured Image from Pngtree, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.