Bitcoin treasury firm Strategy has continued to buy despite the market downturn as it has increased its holdings by another 2,486 BTC.

Strategy Has Added Bitcoin Worth $168 Million To Its Reserves

In a new post on X, Strategy co-founder and chairman Michael Saylor has shared the details related to the latest Bitcoin acquisition completed by the company. With this new purchase, The firm has added 2,486 BTC to its treasury at a price of $67,710 per token or $168 million in total.

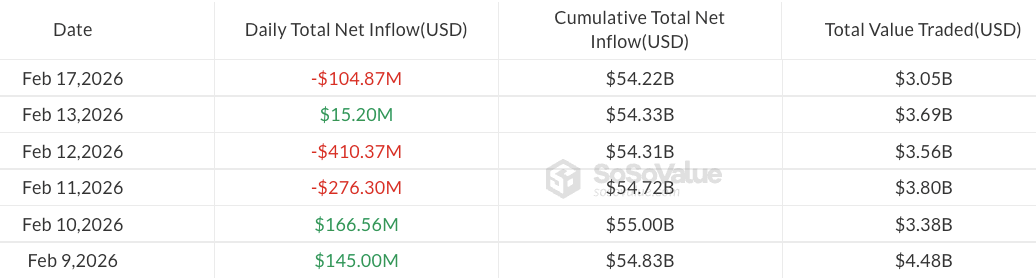

According to the filing with the US Securities and Exchange Commission (SEC), the buy occurred between February 9th and 16th and was funded using proceeds from the company’s STRC and MSTR at-the-market (ATM) stock offerings.

Usually, Strategy drops its purchases on Mondays, but this time the announcement has come on a Tuesday instead. The reason behind it is likely to be the fact that this Monday was a federal holiday: Presidents’ Day.

Following the new acquisition, the treasury firm’s holdings have risen to 717,131 BTC. Strategy spent a total of $54.52 billion on this stack, but at the current exchange rate of the cryptocurrency, its value is just $48.66 billion, meaning that the company’s tokens are holding a net unrealized loss of more than 10.7%.

Strategy’s holdings have gone underwater as a result of the downturn that Bitcoin and the digital asset sector as a whole have faced in recent months. The collapse since the end of January, in particular, has taken the token’s price below the firm’s cost basis. At present, the company’s acquisition level is sitting at $76,027.

Despite its massive reserve dipping into losses, Saylor’s firm doesn’t appear to have given up on accumulating more Bitcoin. On Sunday, Strategy’s official X handle made an X post explaining that the company can withstand a BTC drawdown to $8,000 and still have assets left to fully cover its debt. “Our plan is to equitize our convertible debt over the next 3–6 years,” noted Saylor in a quote-repost

How Strategy's balance sheet will look in the case of an extreme price drop | Source: Strategy on X

Strategy’s latest purchase was its 99th overall since the company adopted a Bitcoin treasury model back in 2020. Saylor’s routine Sunday post foreshadowing the acquisition referenced this, with the chairman using the caption “99>98” alongside an image of the company’s BTC portfolio tracker.

In related news, the largest Ethereum treasury company, BitMine, has also announced a new acquisition. The firm has purchased 45,759 ETH, taking its total holdings to 4,371,497 ETH, equivalent to 3.62% of the total Ethereum circulating supply.

BitMine has continued to buy even as the firm’s holdings have been in a significant amount of loss due to the market downturn. “In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance,” noted Tom Lee, BitMine chairman.

BTC Price

At the time of writing, Bitcoin is floating around $67,700, down nearly 2% in the last seven days.

The trend in the price of the coin over the past month | Source: BTCUSDT on TradingView

Featured image from Dall-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.