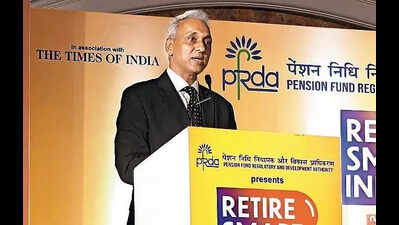

Mumbai: Pension Fund Regulatory and Development Authority (PFRDA) is designing post-retirement income products to outperform conventional annuities while sustaining the double-digit accumulation returns under the National Pension System, chairman Sivasubramanian Ramann said.Addressing the PFRDA Retire Smart India event in association with TOI, Ramann said the brief goes beyond tweaks. “The biggest challenge that PFRDA has got is to put a pension account in each Indian’s hand,” he said, as the regulator pushes corporate adoption.Current rules require 20% of corpus to buy insurer annuities, which are often criticised for modest, inflexible payouts. The regulator is weighing alternatives. “We have to create a product which goes beyond what we call the accumulation phase,” Ramann said, signalling fixed-period, structured payouts rather than life-only streams.The proposed Minimum Assured Return Scheme offers predictable, risk-averse returns. Sponsors cover shortfalls; subscribers share surpluses. Higher fees and defined lock-ins may support long-term sustainability, creating a capital-protected retirement option for new and existing investors.To widen reach, the regulator is going digital-first with low-friction onboarding through UPI apps, targeting informal and self-employed workers. Platform tie-ups with food delivery, ride-hailing, and home services firms aim to enable small, regular contributions for long-term savings by workers “we typically see at our doorstep”.On performance, even conservative NPS options delivered about 9.3% annual returns over a decade, while others posted double digits. An expert committee is charting a future asset-allocation roadmap, including exposure to new asset classes over time.Succession planning is being tightened. Recordkeeping agencies will enable seamless nominee transfers. On tax treatment, he said, “By some unfortunate circumstance, if you do not survive in this world up to 85, you are very well placed within NPS to transfer those assets from your account to your successor’s account.” Such transfers avoid capital gains because “NPS is not a capital asset, it is income.”Speaking to the media, Ramann said that to improve returns, the regulator is looking at allowing new asset classes and is even considering permitting participation in project loans. The PFRDA launched the NPS Swasthya Pension Scheme in Jan as a pilot project to integrate pension savings with healthcare needs. It allows subscribers to save for medical emergencies and save on insurance costs by opting only for a top-up cover over the Swasthya corpus.Ramann said that the focus has pivoted toward private-sector, self-employed and informal workers, while easing features for existing subscribers. There has been some tweaking of the govt pension, and employees can now opt for higher equity exposure under auto choice. Voluntary subscribers face a lower mandatory annuity purchase of 20% versus 40% earlier. The system now recognises 15 years as “long-term savings,” allows participation till 85, and adds a partial-withdrawal window.