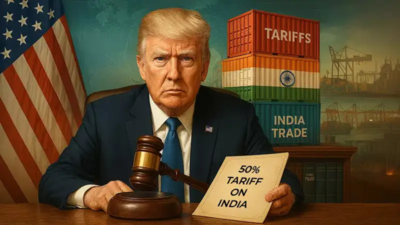

The imposition of a 50% tariff hike by the United States on imports from India weighed on domestic financial conditions in August, with equity markets taking the largest hit, according to a Crisil report. The agency said its Financial Conditions Index (FCI) fell to -0.5 in August from -0.4 in July, indicating tighter conditions compared with the long-term average.According to news agency ANI, Crisil reported that net outflows from foreign portfolio investors (FPIs) continued for the third consecutive month, with equity outflows rising to $4 billion in August—the highest since January—while debt markets saw increased inflows of $1.5 billion, a five-month high. “Persistent FPI outflows and nervousness regarding the impact of tariffs led to a decline in equity market performance, with benchmark indices declining 2% month-on-month,” the report added.The rupee also came under pressure, weakening 1.6% to an all-time low of 87.8 against the US dollar, while the 10-year government security yield rose sharply on concerns over the fiscal impact of the proposed GST rate revision.The report highlighted that the tariff imposition by the US was the key driver behind equity outflows. The Trump administration had raised tariffs on Indian goods to 50%, aiming to curb India’s Russian oil purchases amid the Ukraine conflict. The Treasury argued that “Chinese and Indian purchases of Russian oil are funding Putin’s war machine and prolonging the senseless killing of the Ukrainian people,” and had recently called for G7 allies to impose coordinated measures.Despite the pressure, Crisil said market declines were limited due to expectations of GST rate revisions, a boost to domestic consumption, and the prospect of a long-term sovereign credit rating upgrade for India.On average, the S&P BSE Sensex and Nifty 50 fell 2% and 1.9%, respectively, in August. Meanwhile, softening US Treasury yields and crude prices supported debt inflows, mitigating a sharper impact.