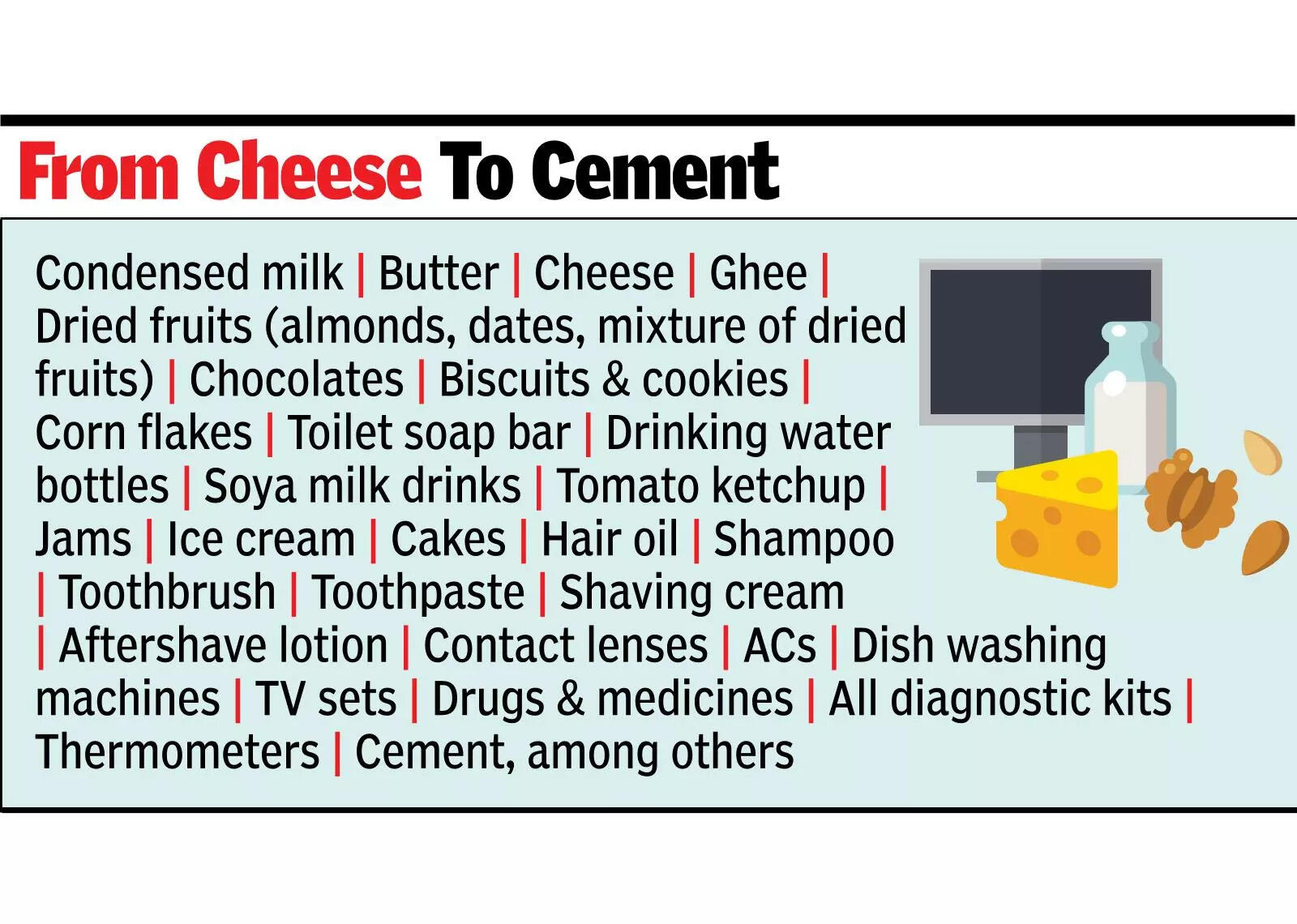

NEW DELHI: Officials from the Central Board of Indirect Taxes and Customs (CBIC) will keep a close eye on price movement of 54 commonly used consumer items over the next six months to ensure that the benefits of lower GST are passed on to consumers.In a recent advisory, CBIC has asked officers to compile monthly prices from field offices and industry bodies, comparing the pre-Sept 22 prices with the level after the reduction is implemented. The first report has to be furnished before Sept 30, it said.The list of products ranges from butter and cheese to corn flakes, toilet soaps, toothpaste to contact lenses, stationary items ACs and TV sets. Missing from the list are segments such as insurance and automobiles.

Last week, the GST Council had decided to reduce the number of slabs, by doing away with the 12% and 28% rates, and announced changes in the case of almost 400 goods and services with 375 seeing a reduction. With the compensation cess to be done away with for all items other than tobacco products, only 13 items will now be in the 40% slab for sin and luxury goods.Govt has been nudging companies and industry bodies to ensure that the prices are lowered in line with the reduction in rates.Addressing the annual meeting of the automotive components anufacturers association on Friday, commerce and industry minister Piyush Goyal urged companies to pass on the benefits after the GST Council decided to put all auto parts in the 18% slab as against 28% earlier.“This massive reduction in indirect taxes… is going to be the biggest reform that the country has seen since independence,” he said.Companies are separately announcing price reductions, although there is no fear of govt using anti-profiteering provisions this time.