MUMBAI: Amid a growing local IPO market which has allowed space to startups with investors betting on India’s tech companies, a new segment is quietly finding its feet in the primary markets-co-working spaces. After Awfis, the first from the sector made a strong debut on the bourses last year, Smartworks and IndiQube Spaces followed. And a host of more are gearing up to take the road to Dalal Street. WeWork India, one of the leaders in the sector, is expected to launch its IPO soon through which it is offering shares worth about Rs 4,000 crore to investors.

“This sector is definitely upcoming and on a positive trajectory. All categories of institutions-mutual funds, domestic and foreign institutions have participated in the IPOs in this space. Even from retail and HNI segment, these IPOs garnered handsome oversubscription,” said Anurag Byas, director, equity markets solutions at Rothschild & Co.

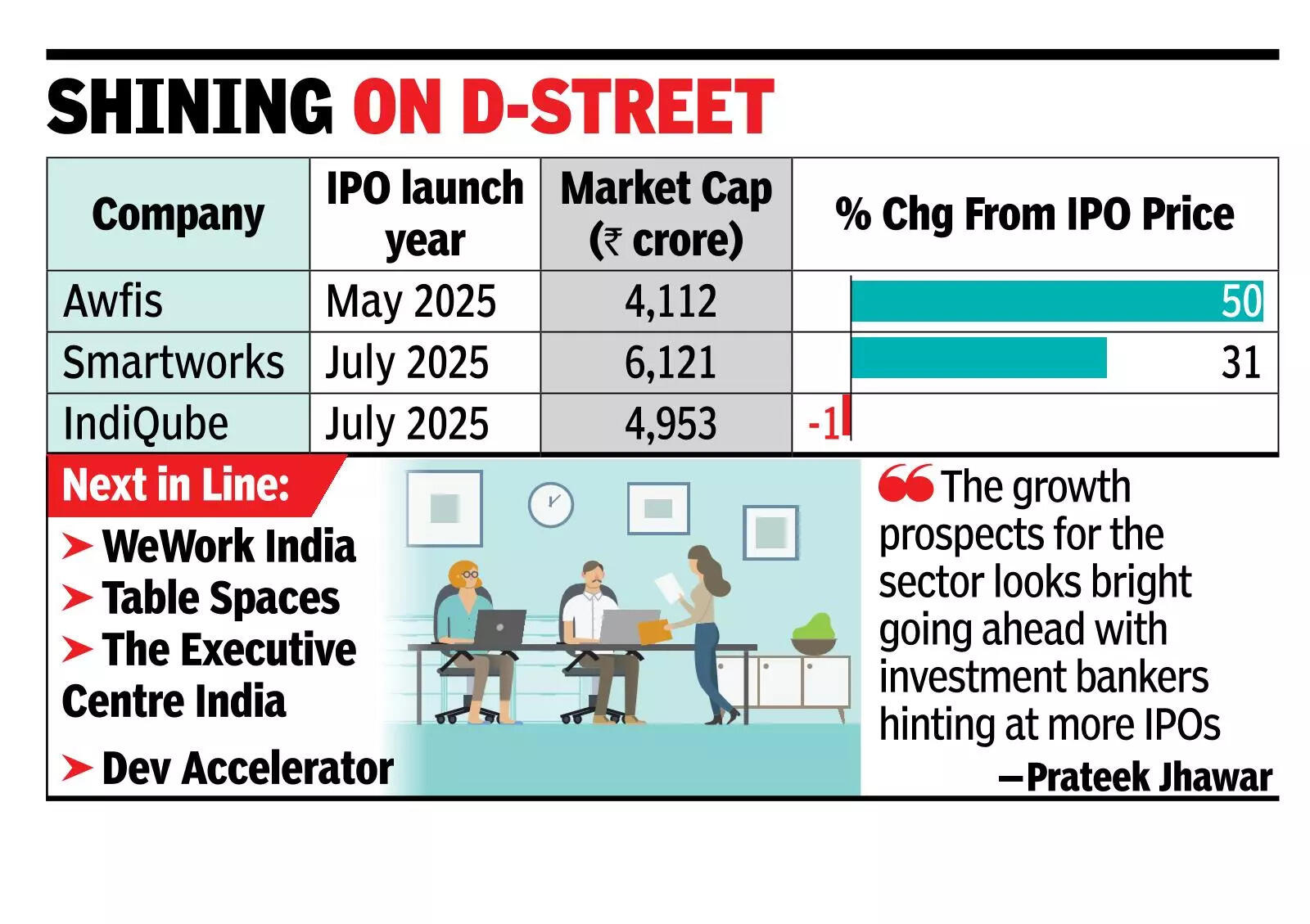

He said that all co-working space companies saw positive listings with Awfis nearly doubling from its IPO price of Rs 383 within five months of debut on the bourses. Currently, the stock is trading just below the Rs 600 mark, still up nearly 50% from the IPO price.

Currently, the three listed startups in the space collectively have a market capitalisation of close to Rs 15,000 crore, data showed. Along with WeWork, at least three others-Table Spaces, The Executive Centre India and Dev Accelerator-are gearing up to go public.

Even as the broader market has remained volatile in recent months, the stock prices of all the three office space companies are trading either at par or above their respective IPO price. What has fuelled investor appetite for IPOs launched by co-working spaces is that the real estate sector saw good growth momentum post pandemic and flex workspaces offered a novel solution to the increasing demand coming in from corporates and startups. This, Byas said, “set the tone” for investor interest in the segment.The growth prospects for the sector looks bright going ahead with investment bankers hinting at more IPOs from the industry. “As enterprises and GCCs fuel a major share of fresh office leasing, we are seeing an interesting turning point for the flex workspace sector,” said Prateek Jhawar, MD & head, infrastructure and real assets investment banking at Avendus Capital.The co-working model is also becoming less cash-burning, particularly as operators mature and scale, said Amit Ramchandani, MD & CEO, investment banking at Motilal Oswal Financial Services, explaining investors’ affinity for the space. Kamraj Singh Negi, MD & CEO, investment banking at Pantomath Capital Advisors said market conditions and valuations are favourable for IPOs.