The expansion to the XRPL will open the stablecoin to a larger user base, possibly increasing its adoption and usage.

The European banking giant Société Générale has launched its euro stablecoin, EUR CoinVertible (EURCV), on the XRP Ledger (XRPL) as part of a multi-chain expansion strategy.

According to an official announcement from SG-Forge, a subsidiary of the Société Générale Group specializing in digital assets, the move aims to increase adoption of the EURCV by leveraging the XRPL’s scalability, speed, and low cost.

SG-FORGE Deploys Euro Stablecoin on XRPL

SG-FORGE first launched EUR CoinVertible on Ethereum and Solana; XRPL is the third blockchain where the stablecoin has been deployed. With support from Ripple’s custody solution, SG-FORGE intends to incorporate the stablecoin into new use cases and the blockchain’s products, to be used as trading collateral.

Ripple’s UK and Europe managing director, Cassie Craddock, said: “Societe Generale-FORGE has long been a pioneer amongst European institutions when it comes to building out a market-leading crypto-assets offering for their customers. Ripple is proud to have played a part in this journey as a long-standing digital assets infrastructure provider to SG-FORGE, providing proven and trusted technology that meets the highest security and operational standards.”

The Societe Generale Group’s digital assets unit sees the stablecoin deployment as a reinforcement to its commitment to offering compliant crypto assets.

“The successful launch of EUR CoinVertible on the XRP Ledger is a new step, reinforcing our commitment to offering next-generation, compliant crypto-assets that promote transparency, security, and scalability. We look forward to further innovation and expanding the reach of our portfolio of digital assets solutions,” remarked the unit’s CEO, Jean-Marc Stenger.

XRPL Integrates Institutional DeFi

Currently, EURCV has a circulating supply of 65.75 million, according to CoinMarketCap. As one of the leading euro stablecoins in the crypto market, the asset is backed by euro cash deposits and securities in compliance with the European Union regulations.

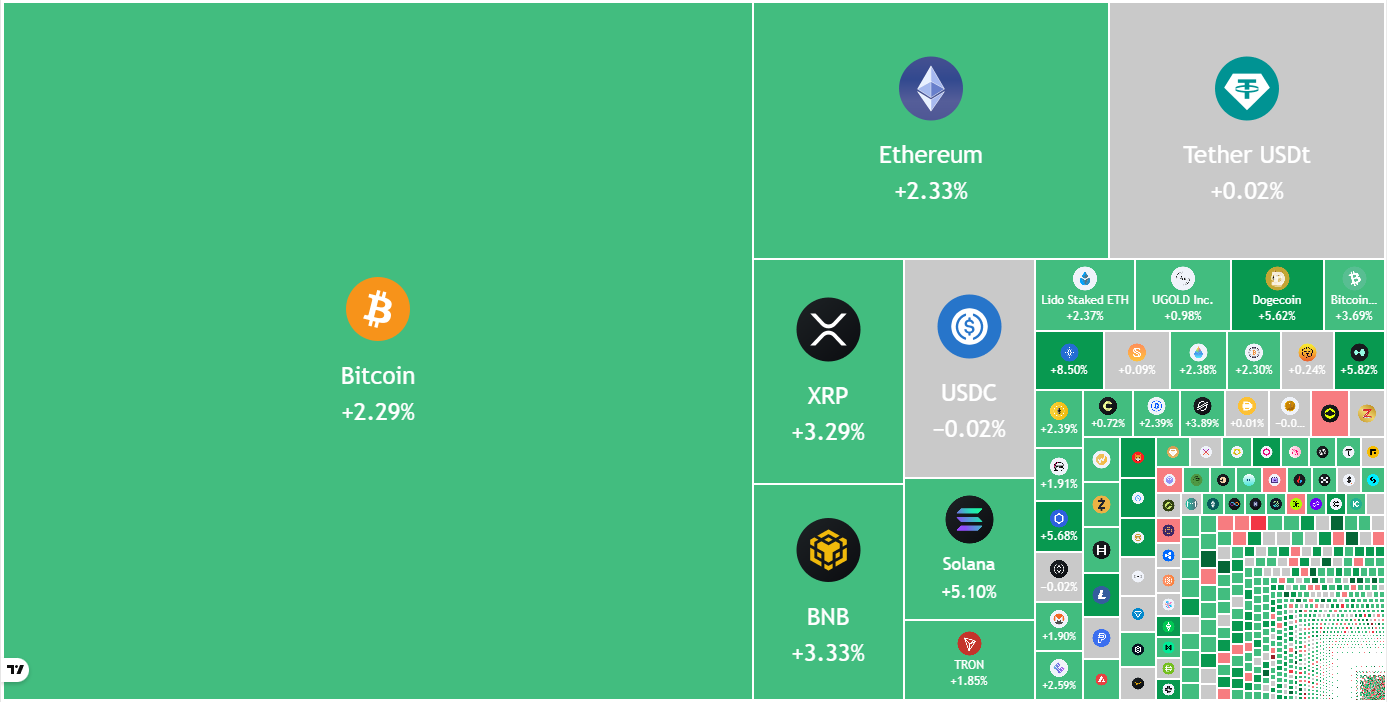

The expansion to the XRPL will open the stablecoin to a larger user base, possibly increasing its adoption and usage. The development comes at a time when the Ripple Network is frequently talked about. CryptoPotato recently reported that advisors at the asset management giant Grayscale classified XRP as the second-most-talked-about asset after bitcoin.

Meanwhile, the XRPL is opening its gates to the institutional decentralized finance ecosystem, as seen in its latest network update. It is expected that this development will bring good tidings for tokens on the XRPL, including the EURCV.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).